We pride ourselves in our innovative yet practical approach, our ability to work closely with clients and their advisors in finding solutions, and in our ability to scale our services as our clients grow. Our clients include public and private companies, as well as institutional investors, all seeking to access the global capital markets for efficient financing structures, operating across numerous sectors, including those featured here.

Structured Finance

For the securitization market, we provide a diverse array of services for issuers, arrangers and transaction managers. Our entity formation, third-party nominee ownership and corporate governance services ensure that bankruptcy remote vehicles used in securitization structures are maintained in good standing, ensuring the proper ring-fencing of assets. Meanwhile, our financial accounting, financial administration, back-up servicing and surveillance services provide the reporting demanded by rating agencies and investors, and allows transaction parties to offload time consuming reporting duties to reliable outside experts.

Special Situations

For atypical events including corporate or fund restructurings, asset dispositions and other material result-driven events, we provide a valuable level of independence to the management and resolution process. Our services include the isolation or disposition of designated assets or liabilities, the governance and/or ownership of corporate subsidiaries and financing vehicles and the disposition and distribution of proceeds from asset liquidations. Our team of highly experienced professionals brings more than twenty-five years of C-suite level experience to assist stakeholders and their advisors in navigating to a satisfactory resolution.

Energy Finance

Many in the energy sector have diversified their traditional capital sources by shifting to non-bank and capital markets-based funding solutions, often utilizing special purpose vehicles (SPVs). We provide an array of corporate governance, accounting and reporting services which can be particularly useful to upstream, midstream and downstream participants. We can also assist companies engaged in a restructuring process, offering an array of solutions for managing newly formed SPVs, asset liquidation and dispositions, and speciality independent director roles. Our past experience includes transactions involving offshore and onshore projects, residential and commercial PACE programs, and government green bank portfolios.

Private Equity

Our hedge fund and private equity fund clients seek to access the global capital markets for customized and efficient financing structures for their investment strategies. For the private equity markets, our services can be particularly useful to emerging and middle-market private equity funds. Increasingly, sponsors utilize SPVs to form their funds and to complete the purchase or sale of portfolio companies. We offer both corporate and trust structure solutions and a complete set of entity formation, management and governance services to our private equity firm clients. In addition, hedge funds regularly utilize SPVs to structure their investments across a variety of asset types, including commodities, financial assets and project finance. Citadel SPV offers our clients a wide array of structural and jurisdictional solutions to meet their customized requirements.

CLOs

Our services for Collateral Loan Obligations and other specialized fund structures provide our clients with a strong combination of Cayman and Delaware governance services, collective experience providing specialized administration and accounting solutions and a unique pedigree for service customization. CLO managers and their advisors also benefit from our speciality services, including independent review party and voting trustee, which are individually tailored to meet the specific needs of managers.

Sports and Entertainment

Our background in sports and entertainment includes working on specialized structures such as league credit facilities, stadium finance transactions, joint marketing programs, film distribution, athlete/entertainer finance, and intellectual property structures. More recently we have worked with digital assets and the tokenization of sports and entertainment assets, as well as strategies for the monetization of social media assets. Working with leagues, entertainment production companies, and intellectual property managers, and their legal advisors and financing partners, we craft customized solutions for each transaction.

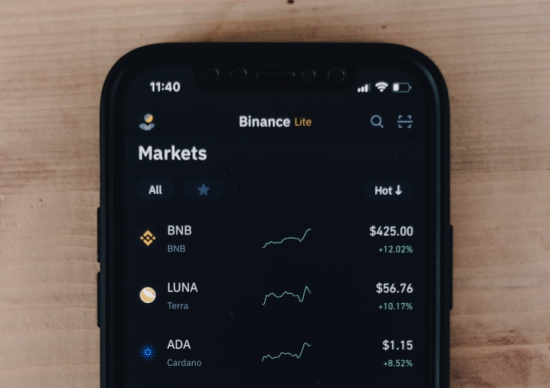

Blockchain

Working with our clients and their advisors, we are assisting in the development of cutting edge independent administrative, governance and accounting solutions aimed at providing continuity, efficiency and transparency to blockchain related strategies across the financial services landscape. We look for areas where we can be helpful in filling the gaps in the relationships between the parties to a transaction. We assist clients in connection with debt capital formation strategies, program and fund administration, jurisdictional compliance, accounting and investor reporting, as well as other customized third-party agent services